Hybrid Long Term Care

Hybrid Long Term Care Insurance plans combines traditional long term care insurance (LTCI) with life insurance. Hybrid LTC policies will pay for home health care, assisted living, adult day care and nursing home services. What if long-term care is never needed? Then the life insurance benefit embedded in the policy will be paid to the family at death. The life insurance benefit value is always at least equal to the premiums paid in – or more.

Receive Competitive Hybrid LTC Quotes from Top 10 Companies

Data Shows That LTC Coverage is More of a Necessity Than an Option

Cost of Long Term Care

Our nation’s population is aging as more baby boomers reach retirement age. By 2040, the number of Americans above the age of 65 will have nearly doubled to reach 80 million. The group needing the most help with personal care – those aged 85 years or old – will nearly quadruple. The demand created by these population trends, combined with other external factors, has resulted in skyrocketing LTC costs.

| Long Term Care Facility | Annual Cost (2024) | Projected Annual Cost in 2030 |

| Homemaker Services | $66,108 | $72,290 |

| Home Health Aide | $62,541 | $73,997 |

| Adult Day Care | $27,116 | $25,157 |

| Assisted Living Facility | $65,238 | $69,646 |

| Nursing Home (Private Room) | $126,64 | $142,299 |

Paying for Long Term Care: What are the Options?

The reason most people purchase long term care plans is so as to protect their assets from the extraordinary cost of LTC services, which can easily run into hundreds of thousands of dollars per year. Individual with a high net worth can choose to self-insure for long term care. How much net worth is enough to insure will vary depending on who you ask, but we only recommend that you consider self insuring if your have assets worth at least $2 million.

Note: if you choose to self-insure, keep in mind that the duration of needing long term care can extend to five years or longer. Take the worst case scenario into account and rethink how following this course of action will affect your retirement finances and legacy.

Traditional LTC insurance has been popular since the 1980s. This type of insurance works similar to your health, homeowner, and auto insurance. Premiums are typically contributed via a ‘pay-as-you-go’ model to make the coverage more affordable. This type of insurance has no cash value. If you do not end up requiring LTC services, then all your premium contributions are lost.

Many existing traditional LTC policies have been subjected to unpredictable premium increases that make these plans unattractive to customers. Furthermore, the ‘use-it-or-lose-it’ approach has made traditional LTC less popular. In the early 2000s, up to 750,000 Americans bought a policy each year, but less than 60,000 bought a plan in 2018. More and more policyholders are ditching this type of coverage and instead opting for more beneficial hybrid insurance.

Certain types of fixed or indexed annuities may be used to offset long term care expenses. Annuities are investment vehicles meant to ensure that you do not outlive your income. They usually pay a monthly benefit upon maturity. If you need long term care, you can tap on the annuity so that you get more (let’s say double) in monthly benefits. The LTC typically starts as a deferred annuity product. It may require a single lump sum premium or structured deposits made over time. If the annuity owner does not need any long term care, then the annuity gains interest and functions like any other fixed annuity. However, if the annuity holder needs care, a formula will be used to establish the amount of benefits available to them every month. Some LTC hybrid annuity products don’t require health qualification as long as you do not already have Alzheimer’s or live in a nursing home.

Note: While annuities can be a reasonable option for long term care coverage, they tend to be less attractive from a benefit perspective. We only pivot to these policies if you have real health issues and cannot medically qualify for traditional or hybrid long term care insurance policies.

Hybrid long term care plans are simply life insurance policies that come with a long term care rider. The policy pays a death benefit (as any life insurance would be expected to) when the policyholder dies. In addition, should the insured person need long term care services when they are alive, the policy works much like a traditional LTC insurance policy. LTC life insurance hybrids essentially kill two birds with one stone. They serve the purpose of conventional life insurance and also provide LTC policies so that whatever happens, the insured benefits from their premiums. As a rule of the thumb, people in their 50’s to mid 60’s will need to put in around $70,000 to $150,000 per person into a hybrid plan to have LTCI benefits similar to a traditional LTC plan. The Hybrid LTC companies will allow you to pay a single premium or pay it over ten years. No further premiums are due, ever.

LTC stats show that most senior citizens in America will need long-term care. If you are not wealthy enough to self-insure, hybrid life insurance is an excellent alternative to traditional LTC insurance and annuities. Most hybrid plans available today come across as affordable, balanced, and practical.

Hybrid LTC vs Traditional Long Term Care

Traditional long term care plans have been around over the last four decades while hybrid plans have only become more popular over the last 10 years. Traditional policies require annual premiums distributed over a number of years. If long-term care is needed, then the policy will pay out benefits in cash value or as reimbursement for receipted expenses. The policy amount is lost if you end up not needing long term care. Hybrid policies will either pay for long term care, or pass a death benefit to your beneficiaries. These policies typically require single lump sum premiums ranging from $70,000 to $150,000, although some companies allow you to distribute premium payments over a number of years.

We usually recommend thinking about an economics 101 term called opportunity cost when comparing LTCI products. Opportunity cost refers to what a person is giving up in a given situation as compared to the benefit they are choosing. The opportunity cost of a hybrid long term care plan is the future potential interest earned on the premium paid in. The key is you have to weigh what kind of future interest you could make if you kept control of that lump sum. You weigh this decision against the tax-free death benefit your family would receive if care is never needed.

Premium stability is a key advantage of hybrid long term care insurance plans. Unlike traditional LTC, hybrid LTC premiums are fixed and will not be increased arbitrarily in the future. This is true whether you purchase your hybrid life long term care policy with a single lump sum premium, or pay multiple annual premiums over a number of years.

Long term care insurance hybrids can also make sense for people with current annuities or life insurance cash value. It is possible to transfer money from those plans tax-free into a hybrid LTCI plan through a IRS 1035 exchange.

Above all the other benefits, hybrid policies are easier to qualify for. Hybrid LTCI will take on cases where the client may have a few more health issues. Traditional long term care insurance companies often would decline these types of cases.

Hybrid Life Insurance Policies are Increasingly Popular

Hybrid long term care insurance plans have been around for about ten years. Over the past two to three years there has been a huge uptick in hybrid LTCI sales.

Here are some of the reasons why:

- Hybrid Insurance plans offer a guaranteed premium that can never be increased.

- These plans will give the client their money back (with interest) at death if care is never needed.

Jim Roberts has sold traditional long-term care insurance in all 50 states since 1998. He has had a finger on the pulse of “what’s next” and has predicted the rise of hybrid LTCI. Roberts also serves as a senior LTC specialist at https://www.hybridlongtermcareplans.com.

In the past 36months we have seen a 520% increase in buyers of hybrid long-term-care insurance. Buyers are opting for hybrid LTC insurance plans in the place of traditional plans 5/1 in 2023. They are also choosing hybrid plans for the premium stability of the hybrid plans and tax free death benefit.

– Jim Roberts

Types of Hybrid Life Insurance Products

Hybrid long-term care plans are crafted from permanent life insurance policies, not term life policies. These can be classified into three different types based on how they are structured:

Linked-in hybrids simply combine LTC insurance with another type of insurance such as life insurance or an annuity. This is the most common type of hybrid insurance and accounts for the majority of long-term care coverage purchased. The policy provides a pool of money that pays for long-term care expenses if needed or returns a death benefit or cash value from the annuity. This type of hybrid coverage is primarily designed to pay for long-term care expenses. The death benefit comes as secondary and is limited to allow for expanded LTC benefits.SAMPLE POLICY

A 60-year-old married woman deposits a one-time premium payment of $90,000. This creates a death benefit worth $154,000 and $463,000 worth of LTC benefits. Given a 6 year LTC benefit period, the policy would pay out $6,429 per month to pay for long-term care expenses. Additional features such as automatic benefit increases for inflation are available as an option when purchasing the policy.

This type of hybrid policy simply adds a long-term care rider to a life insurance plan at the time when you purchase the policy. This is not primarily long-term care insurance but life insurance with an LTC accelerated death benefit option. Should you need long-term care, the death benefit or a section of the death benefit will be made available. Benefits are usually paid out as a percentage of the death benefit each month (e.g., 3% of the death benefit per month).SAMPLE POLICY

Let’s look at a sample policy with a $200,000 death benefit and a 3% LTC benefit rider. This policy would provide $6,000 worth of LTC benefits per month over a duration of 33 months. If the same policy had an 80% LTC acceleration clause, then the monthly benefit would be a little over $4, 800 for each of the 33 months. The remaining (unused) 20% of the death benefit ($40,000) would still remain available as a death benefit.

This is a feature added to a life insurance policy to allow for acceleration of the death benefit to cover care expenses should the policyholder become chronically ill for the rest of their life. While this insurance works very similar to the life insurance with LTC rider hybrid, it is not qualified LTC insurance. Critical illness hybrids are similar but pay out a lump sum when the policyholder is diagnosed with specified medical conditions such as heart attack, stroke, cancer, etc.SAMPLE POLICY

Let’s take into account life insurance policy X that has a death benefit of $200,000 and a free, built-in chronic illness benefit that is accelerated at 70% of the base. This means policy X can offer upto $140,000 in chronic illness benefits. Given a monthly rate of 2%, this adds up to $2,800 per month. However, once the $140,000 is exhausted, the policy terminates with no remaining death benefit, or perhaps just a small residual amount of like $4,000.

Tax Advantages of Hybrid Policies

The amount spent on long term care is subtracted from the death benefit. The remainder of the death benefit, which is awarded to your beneficiaries, is not subjected to any taxation. This is advantageous compared to retirement account assets such as traditional IRA, 401(k) and 403(b) that are taxed when transferred to any beneficiary other than a spouse.

Cost of Coverage

Hybrid LTC is typically more expensive than traditional long term care. This is understandable given that the policy combines both the benefits of a continental life insurance with long term care benefits. Premiums are often paid as a single payment but can also be spread out over a period of time (usually less than 10 years). Unlike traditional LTC policies, premiums where premiums can increase over time, hybrid policy payments do not change.

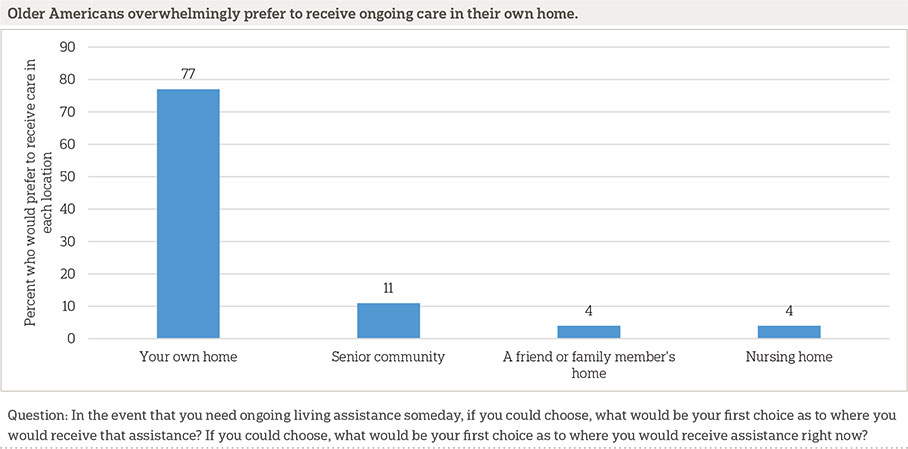

Which care facilities do Americans prefer

Majority (77%) of Americans prefer to receive care in their own home based on the Associated Press NORC long term care poll. This is followed by receiving care in a senior community (11%), a family member’s or friend’s home (4%) and nursing home (4%). The verdict is out, most Americans want to enjoy the comfort of their own home even during old age.

Medicare for Long Term Care

Does it help?

Medicare may cover some long term care services, but usually only provides very limited assistance and cannot be depended on. For instance, Medicare doesn’t pay for long term care or the cost of custodial care (help with activities of daily living such as eating and dressing), which is a big component of the care provided in nursing homes, assisted living centers, and other LTC facilities. To fill the gap in long term care coverage that is left by Medicare, you’d need to consider products such as Medicare Advantage, Medigap, Medicaid, and LTC insurance – all of which are offered by private insurance companies at a premium.

| Criteria | Medicare | Long Term Care Insurance |

| Availability | Generally available to people over 65 years old and younger individuals with long term disability such as permanent kidney failure | There are no age requirements for obtaining LTC insurance coverage. While it may be cheaper to purchase the policy when you’re younger (between your late 40’s and late 50’s), most people wait until they are 60 to purchase coverage. |

| Eligibility for benefits | Long term care eligibility requirements for the original Medicare:

| Under most policies, you are eligible for long-term care benefits when you are unable to execute at least two out of six “activities of daily living” (eating, dressing, bathing, caring for incontinence, toileting, and transferring), or suffer from dementia or other forms of cognitive impairment. |

| Coverage | If you have met all the eligibility requirements, Medicare pays for up to 100 days of ‘skilled nursing care‘ per illness. If you stay in the skilled nursing center for more than 100 days, then you’ll be responsible for the full cost unless you have additional insurance. | Long term care insurance provides extensive LTC coverage in at-home care, assisted living facility, nursing home services, and other facilities. It generally pays for what Medicare doesn’t cover. Once you have successfully filed a claim and the waiting period is over, the policy pays daily or monthly benefits that can continue for years (based on the specifics of your policy). |

Medicaid for Long Term Care

Does it help?

Unlike Medicare (which is operated by the federal government), Medicaid is state-run and provides varying degrees of long-term care coverage. All states have an ‘institutional Medicaid‘ program that provides general health coverage and custodial care (help with activities of daily living) in nursing homes. The requirements for eligibility are that you are unable to perform at least two of the six activities of daily living and that you have almost depleted your income and assets (each state sets its own income and asset limit).

| Criteria | Medicaid | Long-Term Care Insurance |

| Availability | Medicaid is generally available for people aged 65 years or older and younger people with disabilities | Long term care insurance policies can be purchased at any age by qualified applicants, but most people choose to buy this insurance after they reach the age of 60 |

| Eligibility for benefits | To be eligible for Medicaid, you must meet income and asset limits set by your state and you must also be a resident in the state in which you are applying. You must be unable to perform at least two of six activities of daily living before you can file for Medicaid benefits. | LTC benefits usually kick in once a policyholder is unable to undertake at least two out of six activities of daily living (ADLs). |

| Coverage | Medicaid provides broad coverage including doctor visits, hospital expenses, nursing home, and at-home long-term care. Coverage usually starts from the first day in a nursing home. Institutional Medicaid has a look-back period of up to 5 years in most states. However, coverage is only possible once you prove that you have almost depleted your income and assets. | Beverages may be paid out on a daily basis (common with older policies) or monthly basis to help pay for long term care services. The benefit period can vary from one year to unlimited coverage depending on the specifics of the policy. Coverage usually starts after the policy’s designated waiting period. |

| Care facilities accepted | Medicaid is accepted by some nursing homes and in-home care in some states. Adult daycare Medicaid coverage is rare and assisted living facility coverage is not common in many states. Medicaid beneficiaries typically have few options and limited options regarding the type of care that they can receive. | Policyholders often have freedom of choice to receive care in a facility of their choice, including nursing homes, adult daycares, in-home care, assisted living facilities, and more. |

How to Buy a Hybrid Policy

Hybrid LTC premiums can range from $50,000 to $100,000, usually paid as a one-time lump sum. Policyholders who cannot afford to do so or do not want to pay a lump sum can spread out their premiums over a duration of time (e.g. 5 years, 7 years). You end up paying more in total if you choose to spread out your premiums over time. In some cases, policyholders can add an LTC rider to an existing life insurance policy at a reasonable cost, or at least exchange an existing life policy with a life LTC hybrid.

Hybrid policies can be purchased at any age to suit your financial planning goals. Premiums will be cheaper when you are younger and in good health. But most people buy this protection when they are older (above the age of 60). Some companies will even issue policies to Americans who are up to 85 years old.

There is an underwriting process involved to ensure that you qualify for the hybrid life insurance plan you intend to purchase. You’ll need to complete a health questionnaire and do a phone or face-to-face interview with a representative of the insurer. Your medical records and prescription history may be studied to ascertain your current health status. The underwriting process for hybrid policies is usually less complicated compared to traditional LTC insurance, so the majority of applicants easily qualify. However, if you are unable to qualify maybe due to health issues, you can still purchase an annuity with a long term care benefit (death benefit not included though).

Receive Competitive Hybrid LTC Quotes from Top 10 Companies

Testimonials From Our Readers

We saw three different brokers before Patricia suggested we look online. This site presented an online form that we completed in 5 minutes. About a week later, we received a green binder enclosing policies from almost all major LTC insurers in the country. we compared the policy terms and made up our minds within 24 hours. Thank you.

John & Patricia Williams

75 & 71 years old

Buying ltc coverage is something I have always had in mind since I had a major health incident in 2015. Everything became much easier when I learnt about hybrid coverage that preserved my contributions if long term care won’t be needed. Hybrid Long Term Care Plans made it super easy to find the right policy aligned with my retirement plans! Your services are highly recommended.

Tom M.

68 years old

FAQs

What is a hybrid policy?

A hybrid life policy is simply a combination of life insurance and long term care insurance. By default, the policy accumulates a death benefit that is paid out to beneficiaries of the policy holder upon their demise. However, if long term care is needed during the lifetime of the policy owner, then the death benefit is accelerated and used to offset this expense. Any amount that is left after the long term care event is over will still be paid out as the remaining death benefit to appointed beneficiaries of the policy owner. By combining two types of insurance in one, hybrid policies create a win-win situation where the insured is guaranteed to not lose their premiums whether or not they need long term care.

What does Dave Ramsey say about LTC hybrid life insurance?

Dave Ramsey has helped countless Americans iron out their financial planning through his book, keynote speeches, and popular talk radio show. Dave recommends purchasing long term care insurance in order to protect your peace of mind and safeguard your nest egg. Mr. Ramsey says that Medicaid should only never be your first choice for long term care coverage. Regarding the best age for purchasing LTC insurance, Dave suggests that you wait until you reach the age of 60 because the chance of filing a long term care claim before then is quite slim.

Which is better traditional long term care insurance or the new hybrid life LTC combo?

Both life/LTC hybrid products and traditional long term care plans have unique characteristics and may suit the insurance needs of different policyholders. Hybrid life/LTC combos (which are newer in the market) tend to have distinct advantages in that they also carry a death benefit paid to beneficiaries if ltc is not needed and usually also have a cash-value component. With conventional long term care plans that have been around for decades, you lose your entire premiums if you do not need long term care. Furthermore, traditional long term care plans are cheaper and provide larger benefits. The majority of policy holders these days prefer hybrid life LTC combos, but there may still be situations when a traditional plan might make more sense for you.

Which is cheaper traditional LTC policy or hybrid LTC policy?

Hybrid LTC life insurance is generally more expensive than traditional long term care coverage. Premiums in a long term care life insurance hybrid are either paid as a one-time single premium or spread out over a number of years (typically less than 10 years). Those who purchase hybrid life insurance with a one-off premium pay less compared to those who divide their premiums. While hybrid LTC is certainly more costly than traditional LTC, it is important to note that these policies are not impacted by the kind of rampant premium increases that we have seen with life insurance.

One payment hybrid LTC policies, what do beneficiaries get if the LTC insurance isn’t used?

Hybrid long term care life insurance simply combines the benefits of a life policy with LTC benefits. If it turns out that you do not need care, then the policy works like a conventional life insurance with a death benefit paid out to your appointed beneficiary. However, if you need long term care during your lifetime, the policy allows you to accelerate (draw down) the death benefit so you can use it to pay for those services. If anything remains after catering to your long term care needs, then it’ll still be given to your beneficiaries.

Is hybrid long term care insurance worth it?

14 million American adults required long term care services in 2018 alone. Medicaid can help pay for this type of custodial care, but it only kicks in once you prove that you have almost used up your nest egg (assets and income). For this reason, many financial planning experts consider long term care to be one of the most important types of coverage every American nearing retirement age should consider. Long term care insurance plans cover the cost of care if you need these services. Hybrid ltc policies are a specially designed type of LTC insurance that combines life insurance with LTC benefits so that even if you do not require LTC services, your beneficiaries still benefit from the policy. Although premiums tend to be higher compared to stand-alone LTC insurance, many Americans find that life/LTC hybrid products create the right balance between needing long term care and making the most out of your premiums.